The four Basque provinces which

are part of the Spanish State enjoy considerable fiscal autonomy, comparable

to that of any EU Member State. Following two wars during the 19th century the

Basque territories lost most of their administrative and legal autonomy (foral

system) but they were able to reach an agreement with the Spanish Government

to preserve their fiscal autonomy. This agreement between the Basque provinces

and the Spanish State is known as an Economic Accord (in the case of Navarre)

or Economic Agreement (Alava, Vizcaya and Guipúzcoa). We will refer to

these as ‘foral territories’.

WHAT ARE THE ECONOMIC AGREEMENT

AND ACCORD?

The Economic Accord or Agreement

is a system which divides up, within the general tax system of the State, the

various areas of responsibility, and the Basque provinces thus formulate, regulate

and collect all the taxes falling within their jurisdiction. The taxes over

which they have jurisdiction are known as taxes governed by the agreement. The

foral territories obtain their resources directly from tax-payers and with this

money must finance the operation of the public sector; in other words, the foral

territories, like any autonomous tax department, assume all the risks associated

with tax levying.

Legal Framework

Spanish Constitution,

Additional Provision No 1:’ The Constitution protects and respects the historic

rights of the territories with ‘fueros’.’

Autonomous Basque Community:Statute

of Autonomy

Article 40: The Basque Country shall

possess its own autonomous tax department for the purposes of carrying out its

responsibilities and financing them properly.

Article 41.1: Fiscal relations between the State and the Basque Country

shall be governed by means of the traditional foral system of Economic Agreement

or Accord.

Organic Law 12/1981 of 13 May,

adopting the Economic Agreement between the State and the Basque Autonomous

Community.

Foral Community of Navarre:Improvement

of the traditional law (fuero) ,

Article 45.3: Navarre is empowered to maintain, establish and regulate

its own tax system, without prejudice to the provisions of the relevant Economic

Accord.

Organic Law 28/1990 of 26 December,

adopting the Economic Accord between the State and the Foral Community of Navarre.

QUOTA

The foral territories contribute

to the tax department of the Spanish State an overall quota (contribution in

the case of Navarre) as a contribution to all the State’s economic and financial

expenses in the above-mentioned territories for which the foral institutions

have not yet assumed responsibility and as a contribution to solidarity between

regions.

In the case of Alava, Vizcaya

and Guipúzcoa, a law is adopted every five years which lays down the

method to be used and a taxation coefficient is applied to the total amount

of the State’s expenses in areas for which the foral territories have not assumed

responsibility; compensatory adjustments are also made. The taxation coefficient

currently in use is 6.24%, i.e. the foral territories pay for 6.24% of the general

expenses of the State in areas for which they have not assumed responsibility.

We should note that the population of these territories represents 5% of the

total population of the Spanish State

TAX HARMONISATION

The laws governing the Agreement

(Alava, Vizcaya and Guipúzcoa) and the Accord (Navarre) stipulate that

foral legislation shall be in line with the common legislation of the State

and that the foral systems shall maintain an overall actual tax burden equivalent

to that in the rest of the State. This implies that there must be fiscal harmonisation

between all the fiscal systems.

In spite of this, the vague

wording of these articles has engendered legal uncertainty, since the Madrid

government and the foral territories interpret the term ‘equivalent tax burden’

in a very different way.

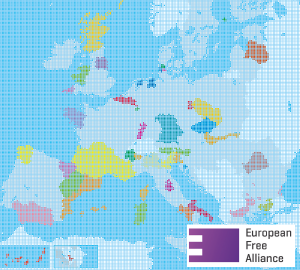

FISCAL AUTONOMY AND THE EU

The foral system of fiscal autonomy

is perfectly compatible with potential fiscal harmonisation in the EU. It should

be considered as just one more tax system among the tax systems of the Member

States.

- ECONOMIC

AGREEMENT BETWEEN THE BASQUE COUNTRY AND THE SPANISH STATE. Introduction to

the concept of the system as agreed. On the integration of our tax system into

the European Union.

- ECONOMIC

AGREEMENT BETWEEN THE STATE AND THE AUTONOMOUS COMMUNITY OF THE BASQUE COUNTRY

(amended text as of May 27, 1997).

Fuente: Eusko Alkartasuna